COTA could go fare-free with a 0.06% sales tax increase

- The middle-school math to calculate the tax increase

- 0.06% sales tax increase is really, really cheap

- Document dump details

- Final notes

Based on COTA's 2021 fiscal audit, I think COTA could eliminate fare for paratransit and regular bus riders, at a 2019 level of service, with a sales tax increase of only 0.06%. That's six pennies' tax increase on a hundred dollars' sales, to make bus fare and paratransit fare free for everyone in COTA's network.

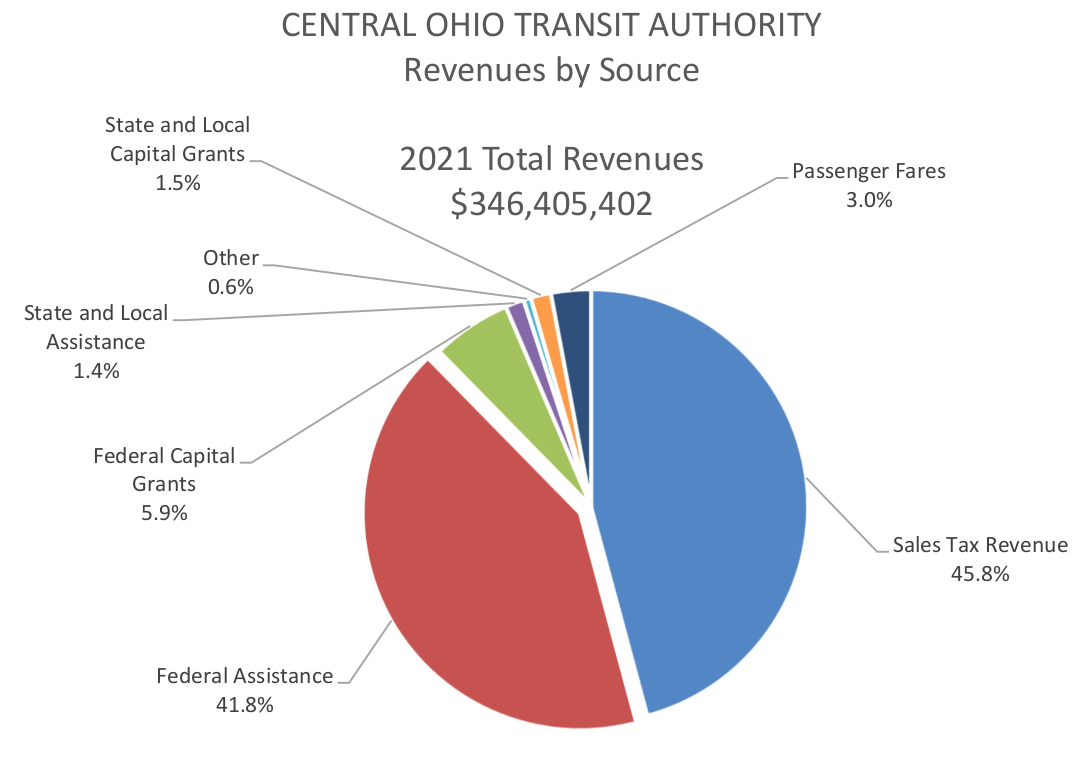

COTA's current sales tax revenue is composed of a 0.25% permanent tax and a 0.25% temporary tax that will last until 2026. These two taxes contributed $158,738,492 to COTA's revenue in 2021, or 45.8% of its total revenue, according to the FY 2021 audit. Passenger fares contributed $10,274,922 to COTA's revenues in FY 2021, or 3.0%. In COTA's highest-revenue year, 2019, general bus fare revenue was $18.2 million and special services fare revenue was $0.8 million, totaling $19.0 million.

How did I reach the increase of 0.06%?

I've obtained the recent financials of the Central Ohio Transit Agency via Ohio Public Records Act request. I've linked the documents below so you can check my math.

The middle-school math to calculate the tax increase

To figure out how much of a sales tax increase is needed, we need to figure out how much the fare revenue is, when expressed as a fraction of the fare revenue.

First, let's see how large the 2019 fare revenue is (highest to date), compared to the 2021 sales tax revenue (highest to date).

$19,031,797 2019 fare revenue

÷ $158,738,492 2021 tax revenue

--------------

0.119

Rounded, the record fare revenue is equal to twelve percent of the record sales tax revenue. So if COTA wanted to eliminate fare revenue, they'd need to increase the tax revenue to 0.12x more than its current rate of 0.5%.

How much would COTA have to increase its sales tax, in order to go fare-free, for 2019 levels of service with 2021 levels of sales tax revenue? How much is a 0.12x increase of a 0.5% tax rate?

Let's cancel out all the units, using the 2021 sales tax income as the baseline amount of revenue 1 revenue:

1 revenue 0.5% sales tax

------------ = ----

1.12 revenue x%

1 rev * x% = 0.5% * 1.12 rev

1 * x% = 0.5% * 1.12

x% = 0.5% * 1.12

x% = 0.56%

Raising COTA's sales tax to 0.56% would make up from the lost fares in going fare-free. And as noted above, collecting fares costs COTA money.

Caveats:

- When bus fare is cheaper, demand for the service increases. This calculation doesn't take the effects of increased ridership into account.

- COTA continues to claim that it is short on bus operators; increases in bus operator wages are not included here.

- This calculation is a 1:1 replacement of fare revenue, and doesn't take into account inflation or other cost shifts.

0.06% sales tax increase is really, really cheap

How much is a 0.56% sales tax compared to a 0.5% sales tax? COTA's tax doesn't apply to groceries, so let's go buy some books at the bookstore.

If your bookstore bill cost $100, you currently pay $7.50 in tax. Raising the tax rate to 7.56% to fund free transit would cost you $7.56 in tax on a $100 bookstore bill: six pennies more from your pocket for every hundred dollars spent, to fund free transit for every COTA rider, whether they're kids taking COTA to school, septuagenarians going to the doctor, partiers riding the bus home from a game, or workers heading home from a long day.

I'd gladly pay six pennies more on a hundred-dollar shopping bill if it meant that more people rode the bus.

I'm sure that COTA has run their own math on how much it would cost to eliminate bus fare. To that end, I've requested that COTA divulge a report that assessed that possibility. We'll see if they produce it.

Document dump details

Beyond this point is just details from a document dump that supported this blog post.

How much does each bus line cost to run?

Does COTA even keep track of costs by route?

I asked COTA for:

the estimated or actual revenue and operating costs per fixed route bus line operated by COTA. Ideally, I'm looking for calendar year 2021, 2020, and 2019 data, broken down in terms of revenue and costs per line, including ridership.

The response included the following useful information:

Please be advised, we do not do cost per hour by fixed bus line.

Download the response letter (47KB Word docx)

If you want to know how much a bus line costs to run, you'll need more information, which wasn't included in this response.

How much does it cost per hour to run a bus line?

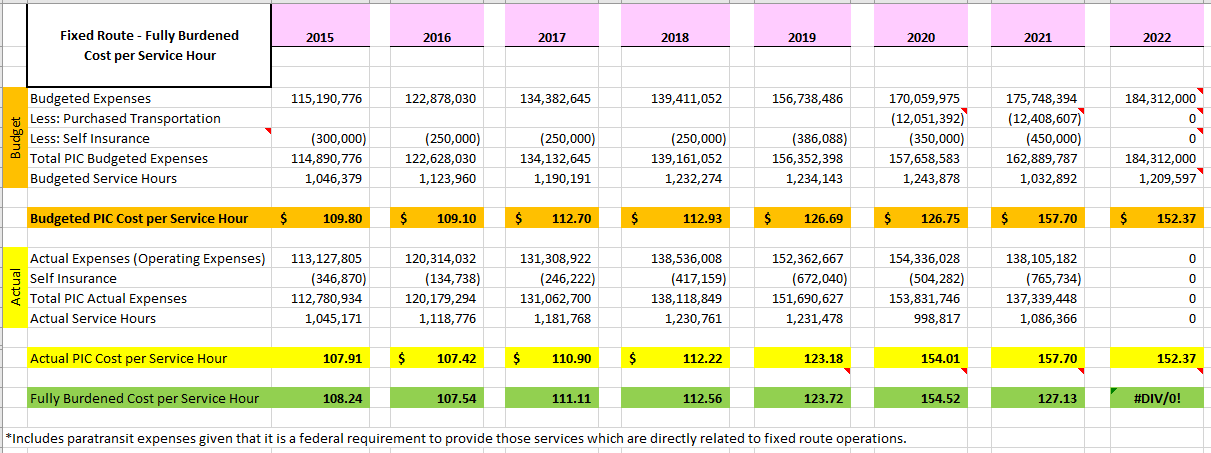

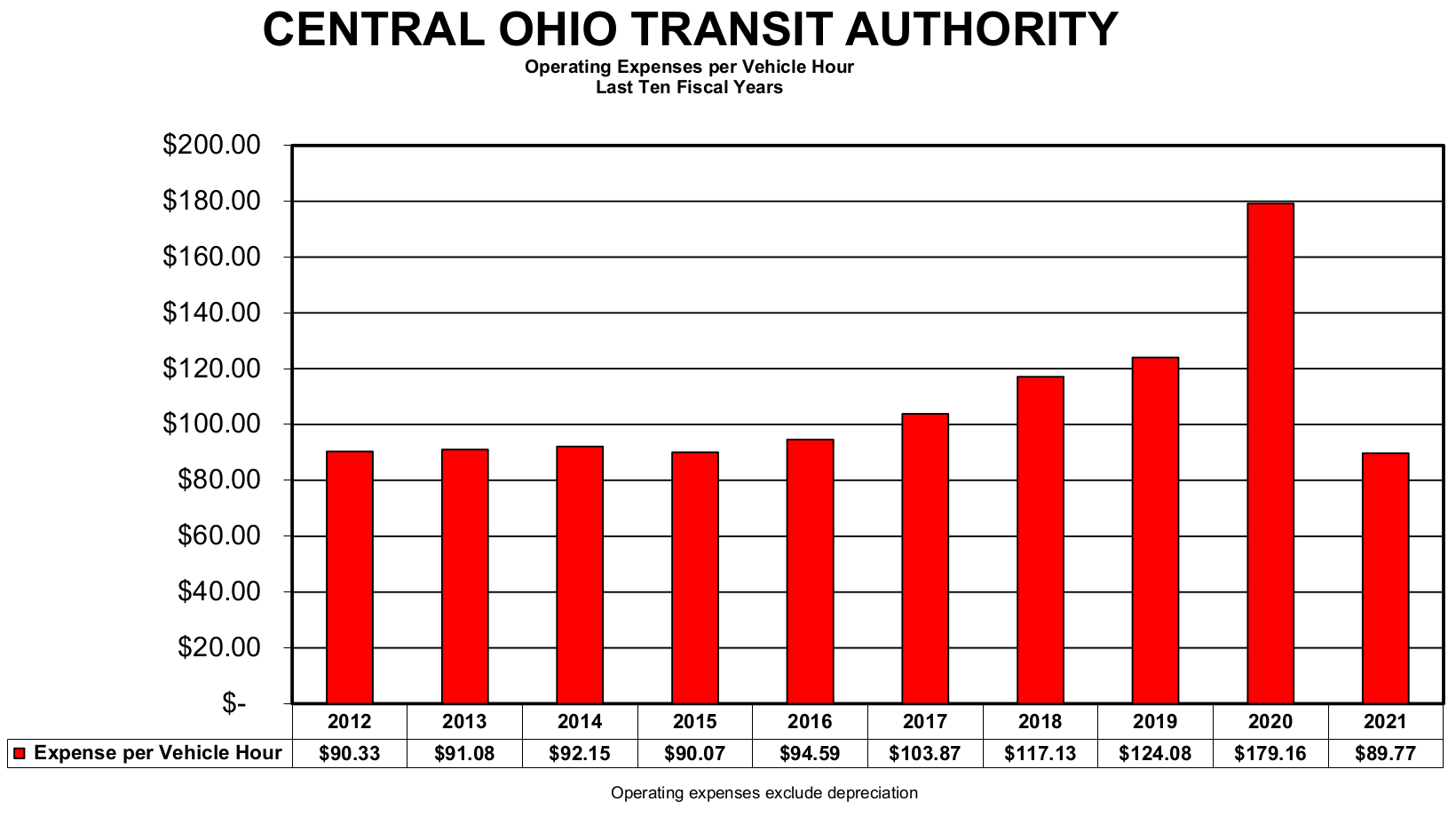

In 2021, COTA says it cost $157.70 per bus service hour. Pre-pandemic, in 2019, it was only $121.18 per hour. These numbers appear to be taking COTA's entire budget and dividing it by the number of bus service hours.

Click to expand the text version of the above image

| type | Category | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Budget | Budgeted Expenses | 115,190,776 | 122,878,030 | 134,381,645 | 139,411,052 | 156,738,486 | 170,059,975 | 175,748,394 | 184,312,000 |

| Less: Purchased Transportation | (12,051,392) | (12,408,607) | 0 | ||||||

| Less: Self Insurance | (300,000) | (250,000) | (250,000) | (250,000) | (386,088) | (350,000) | (450,000) | 0 | |

| Total PIC Budgeted Expenses | 114,890,776 | 122,628,030 | 134,132,645 | 139,161,052 | 156,352,398 | 157,658,583 | 162,889,787 | 184,312,000 | |

| Budgeted Service Hours | 1,046,379 | 1,123,960 | 1,190,191 | 1,232,274 | 1,234,143 | 1,243,878 | 1,032,892 | 1,209,597 | |

| Budgeted PIC Cost per Service Hour | 109.80 | 109.10 | 112.70 | 112.93 | 126.69 | 126.75 | 157.70 | 152.37 | |

| Actual | Actual Expenses (Operating Expenses) | 113,127,805 | 120,314,032 | 131,308,922 | 138,536,008 | 152,362,667 | 154,336,028 | 138,105,182 | 0 |

| Self Insurance | (346,870) | (134,738) | (246,222) | (417,159) | (672,040) | (504,282) | (765,734) | 0 | |

| Total PIC Actual Expenses | 112,780,934 | 120,179,294 | 131,062,700 | 138,118,849 | 151,690,627 | 153,831,746 | 137,339,448 | 0 | |

| Actual Service Hours | 1,045,171 | 1,118,776 | 1,181,768 | 1,230,761 | 1,231,478 | 998,817 | 1,086,366 | 0 | |

| Actual PIC Cost per Service Hour | 107.91 | 107.42 | 110.90 | 112.22 | 123.18 | 154.01 | 157.70 | 152.37 | |

| Fully Burdened PIC Cost per Service Hour | 108.24 | 107.54 | 111.11 | 112.56 | 123.72 | 154.52 | 127.13 | #DIV/0! |

COTA only provided this screenshot of the spreadsheet, pasted in a Word document. They did not provide a meaninfgul response to a follow-up request for the original spreadsheet.

Download the operating costs document (54KB Word docx)

COTA's 2021 comprehensive financial report for fiscal years ending December 31, 2021 and 2020

COTA's 2021 comprehensive financial report is not a line-item budget, but ti does provide a lot of

Download the report (8.9MB PDF)

This PDF opens with a preface by the Auditor of the State of Ohio's investigation into COTA's use of federal funds. COTA's Annual Comprehensive Financial Report starts on PDF page 19, with report page 1 on PDF page 25. Below, I've numbered pages using the report page number.

Select quotes:

At the heart of our advancements is an equitable new fare structure adopted by COTA’s Board of Trustees to increase access to our services for customers who need them most. We simplified child discounts to help families, eliminated restrictions on transfers to benefit high-use riders, and eliminated upcharges on rush-hour lines to serve our community’s workforce.

Our new technology, launched in November 2021, enables unique fare-capping technology, so customers never pay more than $4.50 a day or $62 a month, regardless of how many times they ride in a day. As a result, our cash-paying customers can save hundreds of dollars every year.

While fixed-route transit remained central to our service within the 562 square miles of Franklin County as well as in portions of Delaware, Fairfield, Licking and Union counties, service was delivered differently based on the unique needs and characteristics of individual neighborhoods. In addition to the nearly 8.9 million passengers served on our fixed-route system, COTA Mainstream and Mainstream On-demand provided more than 191,500 rides to individuals whose disabilities prevent them from accessing the fixed-route bus system. (pages 3-4)

In short: COTA is prepared to reduce fares in order to achieve its equity goals. They're prepared to realize a maximum of $2/day/rider, with the current fare capping system.

The trend is continuing but slowing slightly with sales tax receipts through March 2022 reflecting an 11.6% increase over 2021.

In addition to strong sales tax receipts, COTA’s financial position was strengthened due to federal funding provided under the American Rescue Plan Act of 2021 (ARPA), Coronavirus Aid Relief, and Economic Security Act of 2020. As a result of this funding, the COTA Board of Trustees approved the 2022 Operating Budget which reflected a one-time $31.3 million deficit. Of that amount $10.4 million was attributable to project expenditures that are not recurring in nature, while $15.9 million was attributable to the Board of Trustee’s new financial policy commitment to allocate 10% of sales tax revenue to the Capital Improvement Fund. (page 5)

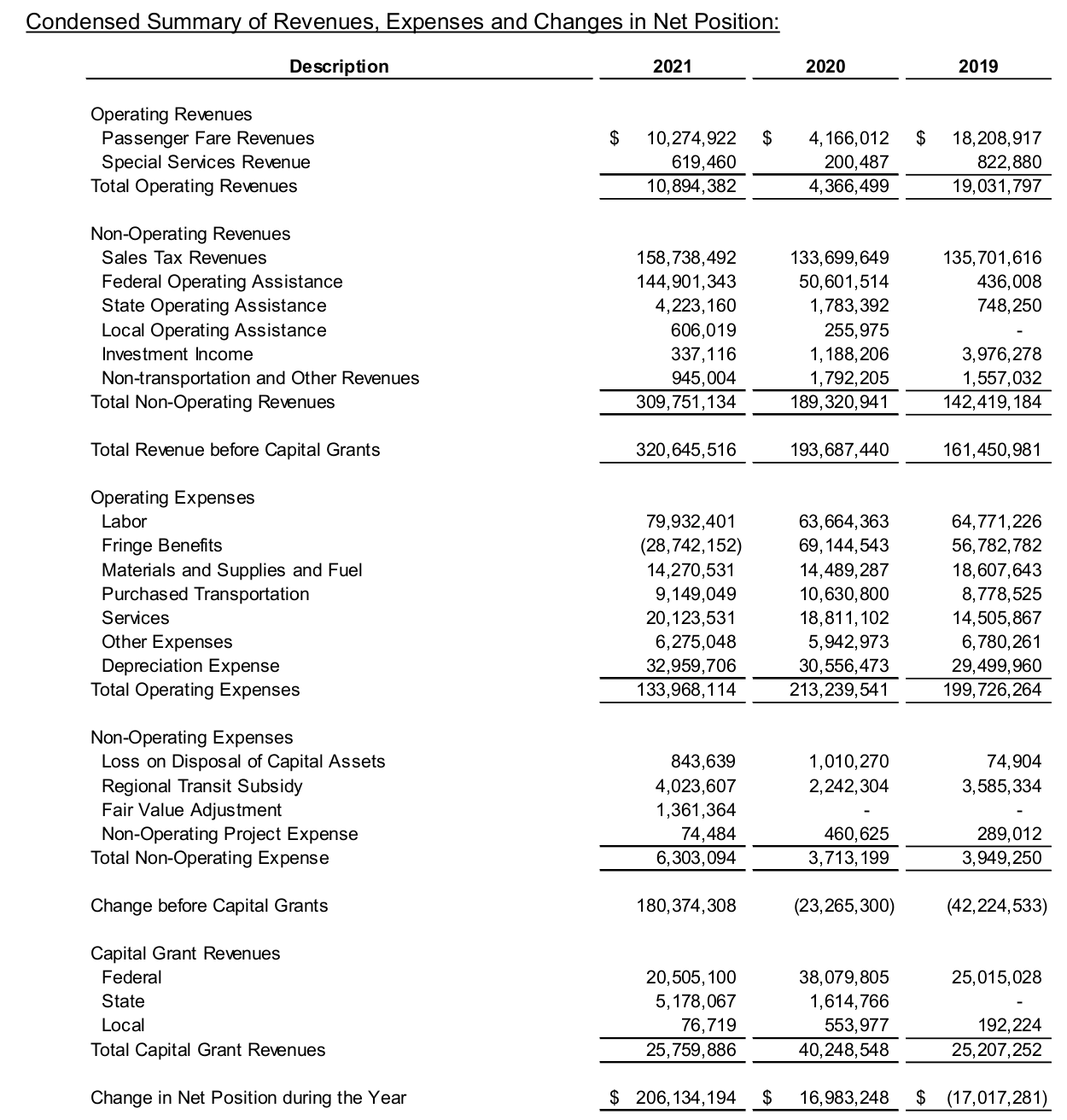

Page 24 of the report provides additional details for this chart:

- Passenger fares: 3%

- Sales tax revenue: 45.8%

- Federal assistance for the §5310 mobility services operating assistance program: 41.8%

- Federal capital grants through §5307 Urbanized Area Formula Grants: 5.9%

- State and local assistance, including refunds on Ohio state diesel taxes and subsidized on-demand : 1.5%

- Investment income: not included in the chart; had been poor in 2020 and 2021

- Non-transportation and Other Revenue, including rental income: 0.6%

- State and local capital grants, and local capital grants, used entirely to pay for 80% of the purchase price of 10 CNG buses: 1.6%

Page 26 describes a problem with the Delaware Area Transit Authority, where because of the 2010 Census regarding the City of Delaware as part of the Columbus Metropolitan Statistical Area, DATA lost a lot of funding. COTA transfers some of the money it gets from the feds and state to DATA. This has been the case since 2013:

In recognition of the financial dilemma that DATA is in, ODOT and COTA have entered into an agreement whereby DATA will receive local funding from COTA for use in public transportation in Delaware County and the [Federal Transit Administration], upon advisement by ODOT, will transfer an equal amount of federal funds to COTA. In 2021, 2020, and 2019, $4,023,607, $2,242,304, and $3,585,334 respectively, was transferred to Delaware Area Transit Authority. (page 26)

Page 28-29: COTA's FY 2021 revenue from passenger fares and special transit fares was $10,894,382, part of a net position change of $206,134,194 in FY 2021. COTA's primary source of funding is sales tax at $152 million, with federal operating assistance a close second at $144 million.

Page 38: COTA spent $153,979 on its contactless fare management system, and has committed to spend an additional $2,065,952 on it. But there's no breakdown on how much is spent on bus farebox maintenance or other overhead from collecting fares. There is also no mention of future plans for fare-free programs or for eliminating cash fare.

Pages 88-89: Statistics about ridership and vehicle operation

- COTA's FY 2021 bus ridership (not including on-demand) was 8.9 million, down from 10,322,492 in 2020 and down from 19,146,510 in 2019.

- The average number of miles that COTA's bus fleet drove on a weeekday was 40,019 in 2021, 31,208 in 2020, and 49,963 in 2019.

- In 2021, the number of miles ridden by all COTA bus passengers was 36,238,372, approximately three times the 12,177,964 miles driven in passenger service by COTA buses. That means that, on average, a COTA bus rider rides for 3 miles. This report doesn't contain the statistical distribution of trip lengths.

Page 91: Miscellaneous statistics about COTA:

- COTA had 957.7 miles of route in 2021.

- 3,049 bus stops, 477 bus stop shelters

- 354 active buses

- average bus speed on fixed-route buses was 14.66 miles per hour, with a fuel economy of "4.36" without units. COTA did not provide a meaningful response when asked what that measure of fuel economy meant.

Final notes

This post would not have been possible without the assistance of COTA's FOIA response team.

In 2019 there was a minor push for free fares at COTA. Read former COTA board member Robert Weiler's column in The Columbus Dispatch:

What stands in our way? Even those who say they support fare-free COTA question how we will pay for it; admittedly, there is no such thing as “free.” However, as with public schools, parks, libraries and “freeways,” we prioritize what is important to make free for our community. Currently, more than 85% of COTA operations are funded by sales taxes. To make COTA fare-free, the remaining 15%, currently paid by riders, could be covered most easily by a 0.1% sales tax increase. Buyers will pay one penny for a $10 purchase, with food, rent and medical expenses tax exempt.

Additional discussion in 2019 included a segment of All Sides with Ann Fisher on WOSU, featuring Robert Weiler, OSU professor of sustainable transportation Harvey Miller, and COTA director of government affairs and special projects Patrick Harris.

Keep an eye on my OPRA request for COTA's free fares report. I'm very curious as to whether they'll release it.

If you're interested in transit advocacy in Columbus, check out Transit Columbus, Sunrise Columbus, and Yay Bikes.